The majority of financial service professionals considers Man In The

Browser as the greatest threat to online banking, cybercrime increases

its use.

Man In The Browser attack,

DDoS attacks,

phishing

are most insidious cyber threats against banking institutions. Last

statistics proposed by principal security firms confirm that online

banking is considered a lucrative business for

cybercrime.

The large diffusion of online banking platforms, their openness to mobile and

social networking

platforms are attracting the attention of cyber-criminals that are

concentrating their effort against online banking services. The first

form of attacks was considered phishing, using social engineering tricks

crocks are able to obtain banking credentials from unaware banking

customers.

Unfortunately also malware authors concentrated their efforts to hit

the growing sector developing new malicious code able to steal banking

credentials from victims often including key-loggers agent and screen

grabbing modules.

The response of banking world was the improvement of

authentication processes,

a classic example is represented by rapid diffusion for multi-factor

authentication such as OTPs (e.g. One-time passwords device/service

(SMS, email), a hardware token).

The cybercrime ecosystem has widely used the man-in-the-browser

attacks to overtake defense systems, let’s see what it is and which are

the countermeasure that could be really effective for user’s security.

The majority of financial institutions in numerous surveys has

considered Man In The Browser as the greatest threat to online banking.

In the classic scheme for the “

Man in the Middle”

attack the attacker lies between the victim client and the banking

server, it’s clear that the introduction of encrypting traffic could

make ineffective the technique.

In the Man-in-the-browser schema the attackers integrate the concept

proper of the above methods with the use of malicious code that infects

victims client component such as the browser. Usually MITB appears in

the

form of BHO (Browser Helper Object

)/Active-X Controls/Browser Extension/Add-on/Plugin/ API – Hooking.

Man-in-the-browser attack is based on the presence on the victim

machine of a proxy malware that infects the user’s browser exploiting

its vulnerabilities. The malware is able to modify transaction content

or conduct operations for the victims in a completely covert fashion.

The malware is usually able to hide its transactions to the client

altering the content proposed by the browser.

The malware is able to bypass multi-factor authentication, once the

bank website authenticates the user that has provided the correct

credentials the Trojan horse waits for the transactions to modify its

content. The malicious code is also able to provide evidence of the

success of the user’s transaction altering the content displayed by the

browsers once executed.

The Man In The Browser attack is a very insidious because neither the

bank nor the user can detect it, despite a multifactor authentication

process,

CAPTCHA

or other forms of challenge response authentication are

implemented. Security experts find that most Internet users (73%) cannot

distinguish between real and fake pop up warning messages neither have

possibility to distinguish malware crafted content.

The majority of financial service professionals in a survey

considered Man In The Browser to be the greatest threat to online

banking, malware such as

Zeus,

Carberp, Sinowal and Clampi have inbuilt MITB capabilities. Recently a Trusteer’s security team identified a new instance of the

Ramnit malware that uses the

HTML injection to target the digital distribution platform for online gaming Steam.

Unfortunate end-users

are

still vulnerable to Man In The Browser attacks, their unique

responsibility it to try to limit the occasions of exposure to attacks

(e.g. Phishing) that could allow the infection of their system.

The most efficient countermeasure is considered out of Band

transaction verification containing transaction details along with OTP

and on bank side the adoption of a Fraud detection based on User

behavior profiling.

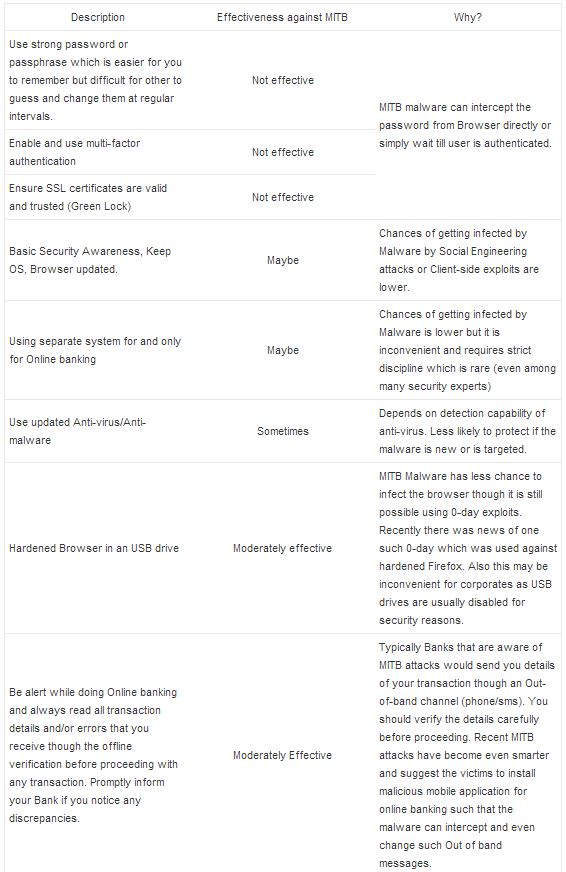

In the following table a useful table that resume principal

countermeasures adopted against a Man-in-the-browser attack and their

real effectiveness.